A financial incentive to invest in renewables

The feed-in tariff enables UK homeowners and businesses to earn a regular income from renewable energy sources such as solar PV panels. Also known as the ‘Clean energy cashback scheme’, this government incentive was introduced in 2010 to promote renewable energy and tackle climate change. It requires energy companies to pay homeowners and businesses for generating renewable electricity.

Solar PV panels can help you financially in three ways:

- Save – Your standard electricity bill will decrease as you will be using less electricity from your supplier.

- Generate – You will be paid for all the solar electricity you generate, including the electricity you use yourself (‘Generation tariff’).

- Export – You receive additional bonus payments for any surplus electricity that is sold back to the national grid (‘Export tariff’).

Over time, this is designed to offset the cost of installation and make a profit of around 5-8% on your investment – much higher than you would earn by saving the same amount in a bank.

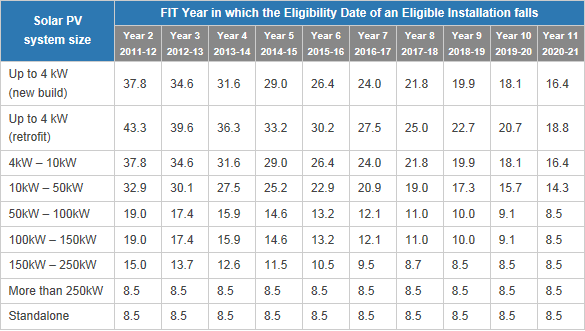

Feed-in tariff rates

When you join the feed-in tarriff, you are paid a set rate from the time you join until the scheme expires in 2035. So the earlier you join the scheme, the more money you can earn. The tariffs are index-linked and will increase in line with inflation. Payments are tax-free for household customers producing energy mainly for their own use.

New build – installed on a new building before first occupation

Retrofit – installed on a building which is already occupied

Standalone – not attached to a building and not wired to provide electricity to an occupied building

Export Tariff

You receive an additional payment for any electricity you generate which you don’t use on site. This is “exported” (i.e., sold) back to the grid network. The current rate is 3.1p per kWh.